About a year ago I decided my collection had reached a point where insurance seemed compulsory and putting off the exploration of options only meant I would be tempting fate every day. It’s not that I felt a catastrophic event was looming over my home or person, but more so that the amount of time, effort and money I’ve tied up in my hobby now required a level of care beyond that which I already provide. Insurance seemed appropriate, I was already ahead of the game because my collection is well documented thanks to tools like Discogs and providing the information that my insurance agent would need was pretty simple. Here’s how I did it.

What You Need to Know First

Earlier this year, I discussed how to catalogue records with Discogs in this post, and most everything discussed here will build on the understanding of that process. If your collection is not already catalogued, the method for information collection that follows will not work for you. So instead, you should take the time to catalogue your records and come back after you’ve completed that process.

How much of a collection needs to be documented? That’s up to every collector to decide for themselves. Maybe you don’t care to document anything less than a certain dollar amount because if it were damaged or lost you could easily replace it. I’ve taken a purists approach; if I own it, it is documented.

But I have Homeowner’s/Renters Insurance Already

As you should, but these policies have strict limitations on how much to expect should you need to rely on them in respect to personal articles. Yes, you may get some money back on items like jewelry, furs and other valuables but not necessarily the full amount you could expect from a personal articles policy. For more information about what is and is not covered by a Homeowners or Renter’s policy, check out the Insurance Information Institute’s FAQ’s.

The How-to Part

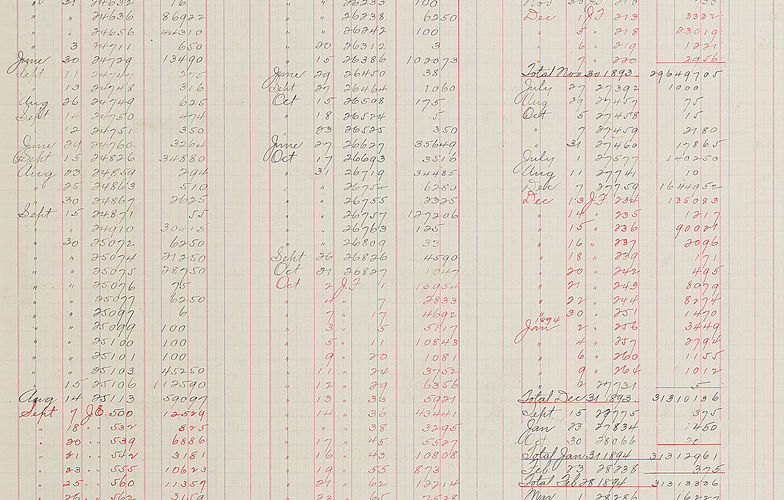

One of the nicest features of Discogs is the ability to export a CSV (comma separated value) file of collections and marketplace histories. These files compatible with Microsoft Excel or any other spreadsheet software. To export your collection, just click the “Export My Collection” link while in your collection tab.

This solution isn’t perfect, however, because an important piece of information is not included in these exports: marketplace sales history. Insurance companies need to have a declared value attributed to each item in order to insure that item, so the lack of marketplace history leaves us with only half the information needed. Last year I did put in a feature request with Discogs so hopefully this is included in a future site update.

Until then, there are two alternatives: manually input prices or copy and paste. I’ve chosen the second option because while it requires a bit more work it also requires a bit less thought because I can’t keep a mental price index for every record I own. But, this also means that the handy export feature is temporarily rendered useless for this project because we are going to literally copy and paste the content from every page of your collection directly into excel as shown below.

You’ll have to clean up the formatting a bit, but it’s a small price to pay in what is basically a very easy solution to what can be a daunting task of manual input.

Scrub your list for duplicates or inconsistencies once you’ve got all the information. I tend to not provide a minimum, media and maximum value, instead choosing to look at the three values and compare them to the condition of my copy while adjusting the value to match. If no value is provided, then use recent eBay sold auction prices or another credible resource. It is highly likely that you will be asked to reveal the source of information to your insurance provider so I usually include a column in my spreadsheets where I attribute a source for each line item.

Choose an Insurance Provider

Now that your collection is well documented in a portable format, it’s time to decide who should insure your collection. I opted to go keep my policy with the same company who carries all my other policies mainly out of convenience and satisfaction with the level of service. There are specialized insurance providers that claim to be specifically qualified to handle collections of antiques, collectables and records but I found no added benefit to using this type of provider.

All said and done, for roughly $100 every quarter, my collection is insured no matter what. I can break a record and submit a claim with few or no questions asked. I pay the deductible; they pay the claim. It can’t get much easier than that.

Setting up my premiums to be paid quarterly allows me to submit addendums on a regular basis since I’m constantly trading records away or buying new ones. A simple email or phone call and I’m all paid and up-to-date. That’s the value of having an insurance agent who understands what you need and there’s no other piece-of-mind like it.

Buy Random Records, Discover New Music Next Post:

Record Store Day and Black Friday

[…] WAXTIMES – how to insure a record collection […]

[…] to be catalogued for a number of reasons but mostly for the ease of tracking your albums and insuring your collection. No matter what tool you use — discogs ftw — start early and keep up-to-date as […]

[…] How to Insure a Record Collection (18,044) […]